Court Declines To Extend Order On Bank-To-Mobile Money Transfer Charges

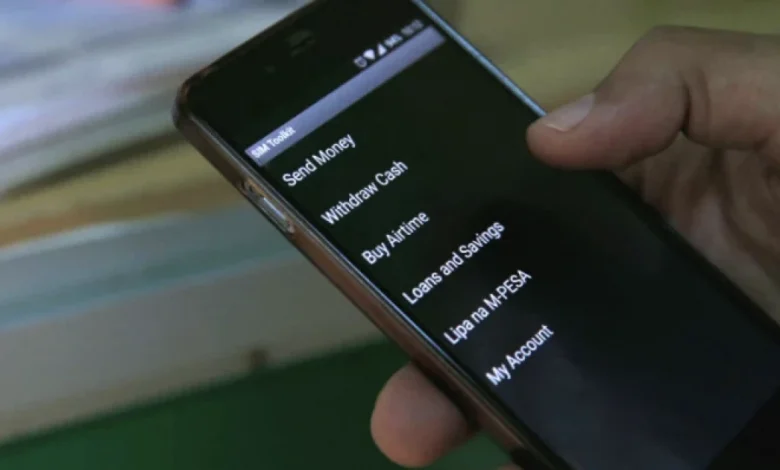

Kenyans will continue paying for mobile money wallet and bank transactions after the High Court declined to extend the temporary orders that had stopped the reintroduction of the charges.

The court had issued orders on January 12 to temporarily stop the reintroduction of the charges, pending a hearing and determination of a petition challenging the reintroduction.

The petitioner, Moses Wafula, argued that the reintroduction of the charges is a violation of his rights and that of members of the public.

“The Applicant contends that his rights and the rights of other members of the public have been violated, infringed and continue to be threatened by the 1st Respondent herein and the Government of Kenya in view of the directive issued by the Intended 3rd Respondent on 6th December 2022,” read court documents.

The petition was filed last year after a notice was issued by the Central Bank of Kenya announcing the reintroduction of the charges effective January 1, 2023.

Wafula argued that unless the court suspends the reintroduction of the charges pending conclusion of the matter, it would be difficult to refund the collected monies in the event the court rules in his favour

“THAT, if the Banks continue riding on this M-Pesa Paybill infrastructure, making money from members of the public, then in the event that this honourable court finds this M-Pesa paybill platform in contravention of the constitution and various statutory provisions, the impact will be higher; more funds from the members of the public would have been lost and it may be a lot more difficult to ask the banks to refund such funds collected from the members of the public,” reads court documents.

Safaricom, the Attorney General, Central Bank of Kenya, the Treasury Cabinet Secretary and the Competition Authority of Kenya have been listed as the respondents respectively.

On December 6 last year, the CBK said the charges were set to be restored from January 1, 2023, following discussions and lobbying between the CBK, banks and payment service providers with the latter two groups pushing for the fees return.